Happy Disability Pride Month! July marks the anniversary of the Americans with Disabilities Act (ADA), which prohibits discrimination based on disability. While we have come a long way as a society in recognizing and accommodating various disabilities,

there is still so much work to be done to make our spaces and systems truly accessible.

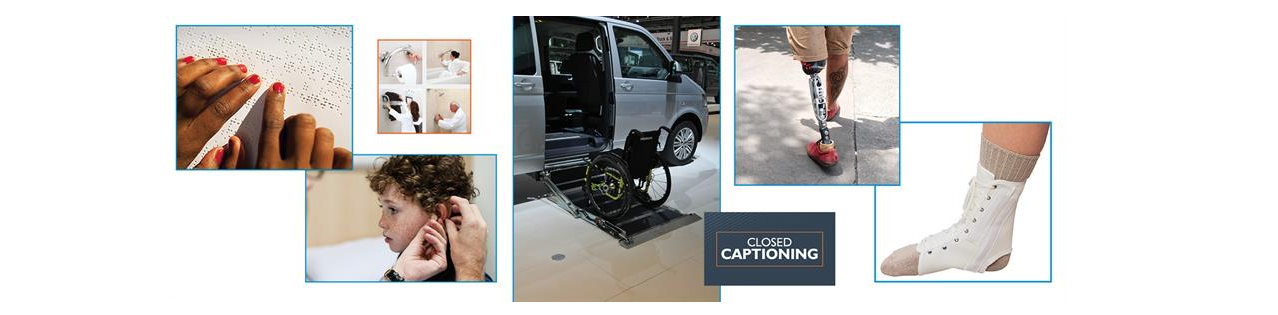

One of the major challenges that people with disabilities often go through is the additional costs that can come with supporting a disability or making an environment more accessible through things like adaptive technologies and home modifications.

In this blog post, we will be discussing the financial effects of ableism and providing some helpful tips and resources to support people with disabilities.

The Financial Predicament of Ableism

Ableism is the prejudice against people with disabilities that is rooted in the idea that people with disabilities are inferior or in need of ‘fixing.’

Ableism results in our homes, public spaces, places of work, technology, products, and more being constructed without considering how they will work for everyone. Considering that more than 1 in 4 American adults live with a disability,1 the

integration of accessibility into our spaces and products from the beginning stages of planning should be essential, but so many of our systems have been well-established without inclusion in mind.

These ableist ideas have created a multifaceted financial predicament for people with disabilities:

- People with disabilities are twice as likely to live in poverty.2 This is due not only to a lack of accommodation in our systems, but also to implicit biases that many employers hold about what a person with a disability is capable of.

- While we have dramatically shifted our implicit biases about sexuality and race over the last 14 years, implicit biases about people with disabilities have hardly changed.3

- People with disabilities are often responsible for extra direct and indirect costs. The National Disability Institute estimates that a household that has someone with a disability that limits their ability to work requires 28% more income to obtain

the same standard of living as able-bodied households.4

- Direct costs include the costs people are responsible for directly because of their disability. This could include health care, services, home modifications, paying more for an accessible car, or even things like paying extra for delivery because in-person pickup isn’t accessible.

- Indirect costs include the earnings that people with a disability may be missing out on because of barriers like employment discrimination. It also includes things like reduced hours or lower-paying jobs that family members or other caretakers may have to take on to support someone with a disability.

Now that we have a broad understanding of the financial challenges that many people with a disability are confronted with, we can understand the importance of financial planning to help prepare for these extra costs.

Maximizing Your Financial Planning

Understand the government benefits and that are available to you

- Social Security Disability Insurance (SSDI) - this is a government benefit that is tied to your work history. It will pay a benefit to you and certain family members if you have a disability and have worked enough years to qualify

while paying Social Security taxes during your time working.

- Supplemental Security Income (SSI) - this is a government benefit that does not require a work history and provides you with money to cover basics that can be accessed if you are 65 or older or have a disability.

- Medicaid and Medicare – these are two different medical insurance plans that offer coverage to people on disability assistance. Typically, if you are eligible for SSI benefits, you can be covered by Medicaid, and if you are

eligible for SSDI benefits, you can enroll in Medicare. However, there are strict eligibility rules, so make sure to find out which option is right for you.

- Local and state programs – check your local and state government programs for additional disability benefits that you may qualify for.

Open an ABLE account

Having savings set aside to prepare for expected and unexpected costs is crucial, but it can be a little complicated for individuals who are receiving government benefits.

One important option is to open an ABLE (Achieving a Better Life Experience) account. Anyone who qualifies for SSI or acquired their disability before the age of 26 (this age

is being raised to 46 in 2026) and meets the severity of disability requirement is eligible to open an ABLE account.

You can contribute up to $17,000 per year, where your money can grow tax-free. It can also be withdrawn tax-free if the money is being used for qualifying disability expenses. One of the biggest advantages is that contributions to an ABLE account don’t

affect eligibility for Medicaid, and SSI amounts can be maintained if the total savings in your account are under $100,000.

Open a savings account

For people with disabilities who do not qualify for SSI and/or ABLE, consider opening a term certificate or money market account with Self-Help to prepare for unexpected expenses.

If your disability requires you to access your funds regularly, a money market account is the way to go – it offers more competitive interest rates than traditional savings accounts, but you can access the funds easily if costs arise.

If your disability costs are more predictable and you tend to prefer saving on a more long-term basis, consider a term certificate. With this option, you would decide on a term length in advance, and during that time, your money earns interest at a guaranteed

rate. The funds aren’t as easy to access, but the rate of return is much higher, allowing your money to grow more substantially over time and prepare for any larger expenses that come down the line.

Consider all your possible costs

Oftentimes, when we create budgets, we are looking at the recurring monthly expenses that we know we can expect. However, disabilities can often mean additional costs that only occur sometimes, which we sometimes forget to consider.

If you know that your disability may require a new home modification, assistive technology, or procedure in the future or every certain number of years, build that cost into your budget now. When we start saving for large costs well in advance, it won’t

be as stressful when it comes time for that spending to happen.

Check for grants that may help cover costs

Public and private grants are offered by different programs and foundations to help cover specific disability-related costs. We’ve listed a few options to explore, but make sure to check out any local programs or organizations that are specifically

focused on supporting your disability for additional opportunities.

Loans are also available

When we think of loans, most of us don’t realize the vast range of products that a loan can cover. Personal loans can be used to cover things like communication devices, home modifications, and personal mobility equipment; vehicle loans can help

with new vehicles and vehicle modifications; and some financial institutions offer access modification and/or assistive technology services loans that can help with more specific disability-related costs.

If you’re interested in a loan to support your disability, Self-Help is happy to work with you to find a loan option that supports your needs and budget.

Ask for support

Financial planning for a disability can have its challenges and everyone’s disability is unique, but there are resources and support available. It’s important to know your options and understand how you can get the best support for you.

Check out these additional resources for additional guidance:

- The National Disability Institute has a Financial Resilience Center with plenty of helpful financial resources.

- Seek out a financial coach. Self-Help offers financial coaches at no additional cost for members, who can help support your personal financial goals.

- Explore your local disability-focused resource center for their offerings.

Sources: